Plan

1/3 of portfolio cash

AAPL stock limit order @ $655.55 for the day

Limit order for the day, I am gone until Tuesday. If it fills, great. If not, no biggie.

-Red Apple

S&P 500 futures technical analysis, market direction analysis and trading. This blog is for educational purposes only.

Friday, August 31, 2012

11:14AM Quick Update AAPL + SPY, Too Fast Too Furious

AAPL doing good, after the signal.

Should re-test 663-665 to form a more solid set-up.

SPY

TFTF, Too furious Too furious, often these set-ups don't end well.

10:38AM AAPL/Apple Technical Update

Bearish continuation as anticipated, need to wait for a solid confirmation to deem this as a buyable bottom. Plus it's a long week and Fed day, most likely won't execute a new trade until Tuesday.

AAPL 60min 100SMA considered to be filled

Awaiting signals/confirmations to indicate a solid bottom, or else this is just a temporary bottom

-Red Apple

Thursday, August 30, 2012

2:43PM Apple/AAPL Technical Update

AAPL hit our $663-665 area, but this is merely just a buyable scalp down and not a hugely oversold condition. 60min RSI is currently 37 with RSI-14 settings.

660 would be the next area of support if we end below 666 today for tomorrow's bearish continuation.

Want to go for bigger meat instead of this 663.5->669 small scalp. Sitting on hands, staying calm

660 would be the next area of support if we end below 666 today for tomorrow's bearish continuation.

Want to go for bigger meat instead of this 663.5->669 small scalp. Sitting on hands, staying calm

-Red Apple

1:28PM SPY Weeklies

Exit

$0.37, 141 SPY calls

Loss

- 2 cents per contract [-5%]

Plan didn't work out, and I don't like the short-term indicators right now, theta would kill these options if SPY goes flat in the afternoon. The loss isn't bad considering if we had chased at 0.42, we would be in a very different situation right now. Will need to stick with higher probability set ups in the next few trades to not go red in portfolio.

Most likely won't trade weeklies tomorrow because of Bernanke speech at 10AM, and will hold onto existing Sept SPY Puts and SPXU shares, still feeling unfortunate that last batch at 40.05 didn't fill.

-Red Apple

$0.37, 141 SPY calls

Loss

- 2 cents per contract [-5%]

Plan didn't work out, and I don't like the short-term indicators right now, theta would kill these options if SPY goes flat in the afternoon. The loss isn't bad considering if we had chased at 0.42, we would be in a very different situation right now. Will need to stick with higher probability set ups in the next few trades to not go red in portfolio.

Most likely won't trade weeklies tomorrow because of Bernanke speech at 10AM, and will hold onto existing Sept SPY Puts and SPXU shares, still feeling unfortunate that last batch at 40.05 didn't fill.

-Red Apple

1:01PM AAPL + SPY Update

AAPL still bearish, 665-663 should hit and possibly more. Take a look at 60min MACD along with support lines

SPY, most likely to 140.80 first then see what happens

-Red Apple

10:10AM SPY Calls Filled

Entry

SPY August 31 141 calls @ .39

Plan

-Red Apple

SPY August 31 141 calls @ .39

Plan

Bought a few more than usual. Looking for a minimum of +50% gain and 100% if momentum comes alive

These kinds of trades have high success rates due to the limitation of the downside given our current circumstances

These kinds of trades have high success rates due to the limitation of the downside given our current circumstances

-Red Apple

9:56AM Quick Update SPY + AAPL

Lowballing the 141 calls right now @ 0.39, a quick rebound looks inevitable. Will adjust accordingly

For AAPL, I don't see solid support until 663-665 which is where 60min MACD should curve along with significant support lines for price there

-Red Apple

Wednesday, August 29, 2012

12:00PM Quick Update AAPL + SPY

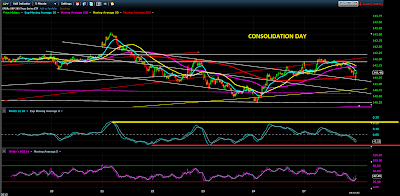

Not much different than yesterday, market still in consolidation mode and the bearish bias for this morning was accomplished now we shall see if we get any true movement in the afternoon

60min MACD shows limited action for both AAPL and SPY at the moment

Not here again this afternoon, so I may post a review tonight

AAPL, short-term bullish above green triangle support

SPY, stuck in 141-142 consolidation mode

-Red Apple

Tuesday, August 28, 2012

6:20PM Quick Review SPY + AAPL

Looks like I was correct, SPY had a consolidation day. AAPL didn't move either. We did the right thing at the time by taking the loss since the OTM calls became unworthy to hold through due price flatness and theta shaving off. We will look for another worthy opportunity to strike again

Tomorrow morning for SPY is bearish bias based on 60min's MACD (12-26-9 settings) weakness, it is also on the zero line. Which means that if it does not have a big gap for either side, we would likely shake/consolidate for the morning and then the real movement will begin after lunch; 12:30PM

AAPL

Not much to say for AAPL, it is still short-term bullish when above the green triangle trend line support

-Red Apple

10:45AM AAPL Update + Exit

Exit

AAPL August 31 Weekly Calls @ 4.00

Loss

$2.6 per contract [-39%]

We wanted to take half off and limit stop the rest but we decided not to because we are almost 2 strikes OTM so the circumstances say we should take the loss entirely and wait for the next opportunity.

Not here for the rest of the day, will post a review tonight.

SPY

SPY, nothing to say, still looks like a consolidation day

-Red Apple

Monday, August 27, 2012

3:37PM Ideal Closing Price Area

Apple still looks like a gap up scenario, condition being nothing decisively lower than 673.54 which is the LOD

Chart below shows the ideal closing price area for Apple

Ascending triangle pattern

-Red Apple

1:50PM Quick Update with Chart

AAPL

Labeled support, not much to say. Overall, bullish chart, and looks like setting up for a gap up scenario if my predictions are right

QOTD; The trend is your friend

QOTD; The trend is your friend

-Red Apple

12:28 Apple 680 Weekly Options Entry Plan

Plan

Bidding the AAPL August 31 680 Weekly Calls at 6.00-6.05

+50% minimum target for these weeklies upside potential

Will post entry once it has been filled

(Waiting for SPY confirmation on the short term uptrend if in sync or not)

-Red Apple

Bidding the AAPL August 31 680 Weekly Calls at 6.00-6.05

+50% minimum target for these weeklies upside potential

Will post entry once it has been filled

(Waiting for SPY confirmation on the short term uptrend if in sync or not)

-Red Apple

10:10AM AAPL Stop Loss Cover

Exit

Covered AAPL short stock @ 674

Loss

$5.95 per share

New Plan

Since the downside dream did not come true, thinking if we should buy some 680 weeklies for this second leg up

-Red Apple

Covered AAPL short stock @ 674

Loss

$5.95 per share

New Plan

Since the downside dream did not come true, thinking if we should buy some 680 weeklies for this second leg up

-Red Apple

Friday, August 24, 2012

10:10AM AAPL Lottery Exit

Exit

AAPL August 25 655 Weekly Puts @1.2

Loss

$1.8 per contract [-60%]

No Regret

Remember when we entered these weekly puts, it was a lottery side bet, and we said it was an all or nothing bet, extremely risky. We were prepared to lose it all, so it's okay. We keep our lottery bets very small with the house money we made.

(http://aapltechnicals.blogspot.ca/2012/08/210pm-aapl-side-bet-important.html)

Portfolio

Maintain the plan for these swing shorts, will adjust accordingly to market dynamics

-Red Apple

AAPL August 25 655 Weekly Puts @1.2

Loss

$1.8 per contract [-60%]

No Regret

Remember when we entered these weekly puts, it was a lottery side bet, and we said it was an all or nothing bet, extremely risky. We were prepared to lose it all, so it's okay. We keep our lottery bets very small with the house money we made.

(http://aapltechnicals.blogspot.ca/2012/08/210pm-aapl-side-bet-important.html)

Portfolio

September Monthly 130 Puts @ 0.68 (Average cost)

SPXU @ 41.75

Shorted AAPL common stock @ 668.05 Maintain the plan for these swing shorts, will adjust accordingly to market dynamics

-Red Apple

Thursday, August 23, 2012

4:05PM AAPL Bear Porn Dream + Next Plan

Here is the bear porn dream for tomorrow, 648 first step, 640 second step.

AAPL lotteries have decayed to about $1 per contract from $3.

Wednesday, August 22, 2012

3:15PM AAPL, Short Stock

Entry

Shorted AAPL common stock @ 668.05

Stop loss

Will cover if closes above 672.50 for 5 consecutive minutes

Plan

4 bucks risk for 20 bucks potential

This is a much safer trade and higher probability than the lottery tickets trade because there's no expiration date for stock. This is a swing trade

-Red Apple

Shorted AAPL common stock @ 668.05

Stop loss

Will cover if closes above 672.50 for 5 consecutive minutes

Plan

4 bucks risk for 20 bucks potential

This is a much safer trade and higher probability than the lottery tickets trade because there's no expiration date for stock. This is a swing trade

-Red Apple

2:10PM AAPL Side Bet *IMPORTANT

Entry

AAPL August 25 655 Weekly Puts @ 3.0

*Plan

This is strictly a lottery type trade/ all or nothing , therefore it is definitely extremely risky. Only using very little house money.

Quadruple Target

Sell limit @12.00 per contract

-Vegas Blood Red Apple

AAPL August 25 655 Weekly Puts @ 3.0

*Plan

This is strictly a lottery type trade/ all or nothing , therefore it is definitely extremely risky. Only using very little house money.

Quadruple Target

Sell limit @12.00 per contract

-Vegas Blood Red Apple

12:00PM AAPL Major Line

AAPL still in consolidation mode

Sometimes it's better to sit on your hands until you find a higher probability set-up that you're comfortable with.

Don't make the rookie mistake, DON'T OVERTRADE

-Red Apple

Tuesday, August 21, 2012

2:50PM Risk vs Reward 101

Consolidation pattern I see for the rest of the day AAPL, not re-entering today.

I think we did some excellent risk management today.

This pic kinda describes today, bittersweet

Until tomorrow

-Happier Red Apple

1:56PM AAPL Profit Part 2

Exit

Sold last half AAPL August 25 655 Puts @8.50

Profit

August 25 AAPL 655 Weekly Puts, $ 3.5 per contract [+70%]

AAPL 1min and 5min shows a wedge, and we're likely going to rebound to 657-658, so we're taking all profits and planning to re-enter back there

-Red Apple

Sold last half AAPL August 25 655 Puts @8.50

Profit

August 25 AAPL 655 Weekly Puts, $ 3.5 per contract [+70%]

AAPL 1min and 5min shows a wedge, and we're likely going to rebound to 657-658, so we're taking all profits and planning to re-enter back there

-Red Apple

AAPL Profit

Exit

Sold 1/2 AAPL August 25 655 Puts @8.65

Profit

August 25 AAPL 655 Weekly Puts, $ 3.65 per contract [+73%]

Keeping the last half for the measure move target, made back the losses from yesterday and a lot more

-Less Pissed Red Apple

Sold 1/2 AAPL August 25 655 Puts @8.65

Profit

August 25 AAPL 655 Weekly Puts, $ 3.65 per contract [+73%]

Keeping the last half for the measure move target, made back the losses from yesterday and a lot more

-Less Pissed Red Apple

12:20PM SPY + AAPL Holdings Update

Plan

SPY thesis unchanged from last week

AAPL looking for a minimum 50% gain

Portfolio

SPXU 50%

SPY thesis unchanged from last week

AAPL looking for a minimum 50% gain

Portfolio

September Monthly 130 Puts @ 0.68 (Average cost)

SPXU @ 41.75

August 25 Weekly AAPL 655 Puts @5.0

Limit Order

- Unfortunately, the last half of SPXU limit order @ 40.05 did not trigger. SPXU went as low as 40.12. Unbelievable

Allocation Strategy Clarification

- Often times, my asset allocation model is 50% stock, and 30% options (weekly options + monthly options), and 20% cash. I like this for its flexibility and risk vs reward. Of course, there will always be exceptions, and I would trade a larger percentage in options if the criteria for a very high probability trade is met.

Example

SPXU 50%

AAPL Weeklies 20%

SPY Monthlies 10%

Cash 20%

-Red Apple

12:00PM AAPL Update

I couldn't monitor the morning market so I missed the first short entry, but our plan from yesterday worked. Taking a small loss, then re-entering is a good strategy if you want to avoid gap ups. Pretty pissed off right now that I had to be away and missed the double. That's life, right?

Entry

August 25 AAPL 655 Puts @ 5.00

Plan

Will most likely keep these until end of tomorrow

Here's a lesson

I gave many of these small lessons in my skype group, but will share with newcomers here

-Pissed Red Apple

Monday, August 20, 2012

3:30PM AAPL Puts Exit

Exit

Sold all AAPL August 25 655 Puts @ 4.55

We took the loss because, a gap up will not do these OTM puts any favours since we're ending on a high note.

Loss

$0.35 per contract [-7.1%]

Tomorrow

Momentum days like these and ending high pretty much guarantees a higher high the next day. We will try this trade again tomorrow, no biggie.

-Red Apple

Sold all AAPL August 25 655 Puts @ 4.55

We took the loss because, a gap up will not do these OTM puts any favours since we're ending on a high note.

Loss

$0.35 per contract [-7.1%]

Tomorrow

Momentum days like these and ending high pretty much guarantees a higher high the next day. We will try this trade again tomorrow, no biggie.

-Red Apple

1:08PM AAPL 655 Puts Filled

Entry

August 26 Weekly Puts 655 Strike @ 4.90

Note, we may not enter the 660 Puts, if we do, we will post entry after it has been filled

August 26 Weekly Puts 655 Strike @ 4.90

(We are not scaling in, this is final)

Note, we may not enter the 660 Puts, if we do, we will post entry after it has been filled

11:40AM AAPL Shorting Plan For Today

Today's circumstances/indicators are virtually identical with the 530 bottom which we successfully traded. The only difference is we're playing a (temporary) top this time instead of a bottom.

This afternoon, we are going to be shorting AAPL with the August 25 Weekly Puts. Most likely a combination of the 655 strike and 660 puts.

Profit target for the 655 strike is a quick double

We will post the entry once it has been filled.

Note, still maintaining SPY net short plan and still have the same holdings

-Red Apple

Tuesday, August 14, 2012

10:00AM High Probability Trade Execution Part 3

Quick Update

Luckily, I have been away from the stagnant market for the past few days, not much has changed. SPXU finally went below $42 mark and the 140 SPY September Monthly Puts below $2.50. At the moment, we are not entering the 140 SPY Puts because we want to save some money to trade AAPL.

Remember folks, these are planned swing trades 2 weeks plus, unless profit target hits faster than expected

Entry

Scaled in 1/2 of SPXU @ 41.75

(Last half, buy limit is SPXU 40.05 if we get there)

Portfolio

September Monthly 130 Puts @ 0.68 (Average cost)

SPXU @ 41.75

AAPL Update

Have a limit order for the AAPL September 600 Puts @ 5.05

(Subject to change, if it shows no weakness on 5min chart this afternoon)

AAPL hourly RSI-14 is approaching to extreme overbought zone(low 90s), currently in the low 80s

-Red Apple

Tuesday, August 7, 2012

10:40AM High Probability Trade Execution Part 2

Entry Plan

Our internal SPY target reached, we scaled in the last half of the Sept Monthly 130 Puts.

We are going to maintain our previous plan to enter more short positions if SPXU gets under 42 and the Sept Monthly 140 Puts under 2.5 per contract. So far so good.

Entry

SPY September Monthly 130 Puts @ 0.62 (The last half we planned for)

Portfolio

September Monthly 130 Puts @ 0.68 (Average cost)

-Red Apple

(Edit, added new charts)

Subscribe to:

Posts (Atom)